In the dynamic and ever-changing world of business, the role of corporate finance has become increasingly crucial in driving the success and growth of organizations across a wide range of industries. From managing capital structures and investment strategies to optimizing cash flows and mitigating financial risks, the principles and practices of corporate finance serve as the foundation for sustainable business performance.

The Challenges of Modern Corporate Finance

However, the modern corporate finance landscape is not without its challenges. Businesses today face a complex web of economic, regulatory, and technological shifts that demand a more holistic and innovative approach to financial management and strategic decision-making.

Introducing Asset Finance: A Complementary Solution

As businesses navigate the evolving corporate finance landscape, a specialized financial solution has emerged to complement and enhance the effectiveness of traditional corporate finance strategies – asset finance.

The Fundamentals of Asset Finance

At its core, asset finance is a financing approach that leverages the value of a company’s tangible and intangible assets, such as equipment, machinery, intellectual property, and even future cash flows, to secure the necessary capital for business operations, investments, and growth initiatives.

Equipment Financing

One of the primary components of asset finance is equipment financing, which provides businesses with the resources to acquire, upgrade, or replace mission-critical equipment and machinery, ensuring the continued operational efficiency and competitiveness of the organization.

Leasing and Rental Solutions

Another key aspect of asset finance is the availability of leasing and rental solutions, which enable businesses to access the use of assets without the need for outright ownership, freeing up capital for other strategic priorities.

Intellectual Property Financing

Additionally, asset finance can also encompass the financing of intangible assets, such as patents, trademarks, and copyrights, unlocking the inherent value of a company’s intellectual property to fuel innovation and growth.

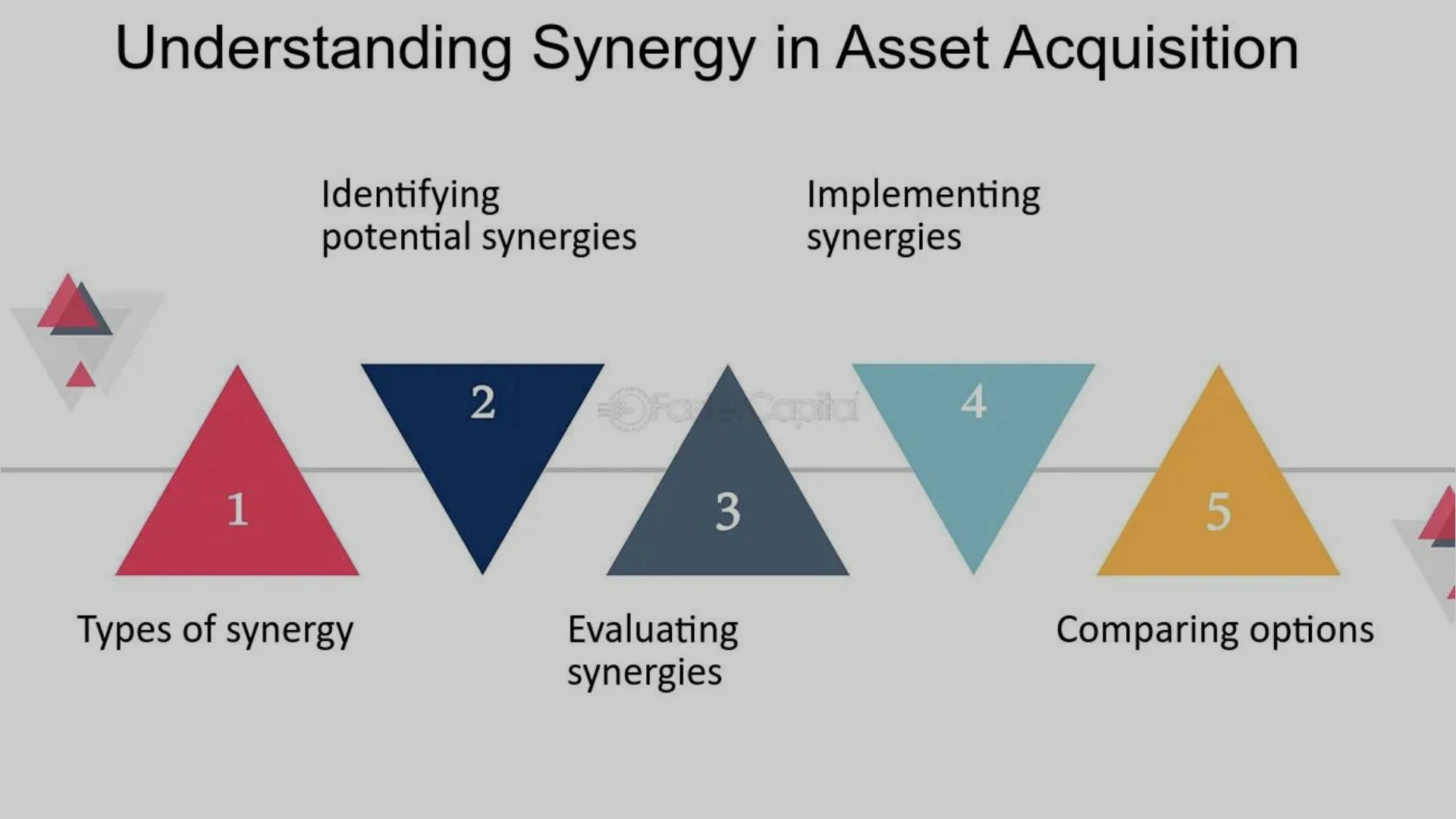

The Synergistic Relationship between Corporate and Asset Finance

By seamlessly integrating corporate finance strategies with the specialized solutions offered by asset finance, businesses can unlock a powerful synergy that amplifies their financial capabilities and supports their long-term success.

Optimizing Capital Allocation

One of the key benefits of this synergistic relationship is the ability to optimize capital allocation across the organization. By leveraging asset finance to secure the necessary capital for specific investments or operational needs, businesses can free up valuable resources that can be redirected towards other strategic priorities, such as research and development, market expansion, or debt reduction.

Enhancing Financial Flexibility

The combination of corporate finance and asset finance also enhances the financial flexibility of businesses, allowing them to adapt more nimbly to changing market conditions, seize emerging opportunities, and weather unexpected challenges without compromising their overall financial stability.

Improving Risk Management

Furthermore, the integration of corporate finance and asset finance strategies can significantly improve the overall risk management capabilities of an organization. By diversifying their financing sources and leveraging the inherent value of their assets, businesses can mitigate financial risks, reduce their exposure to market volatility, and enhance their long-term resilience.

Unlocking Growth Potential

Ultimately, the synergistic relationship between corporate finance and asset finance empowers businesses to unlock their full growth potential. By aligning these complementary financial solutions with their strategic objectives, organizations can accelerate their progress, expand their market reach, and solidify their competitive advantage in an increasingly dynamic and challenging business environment.

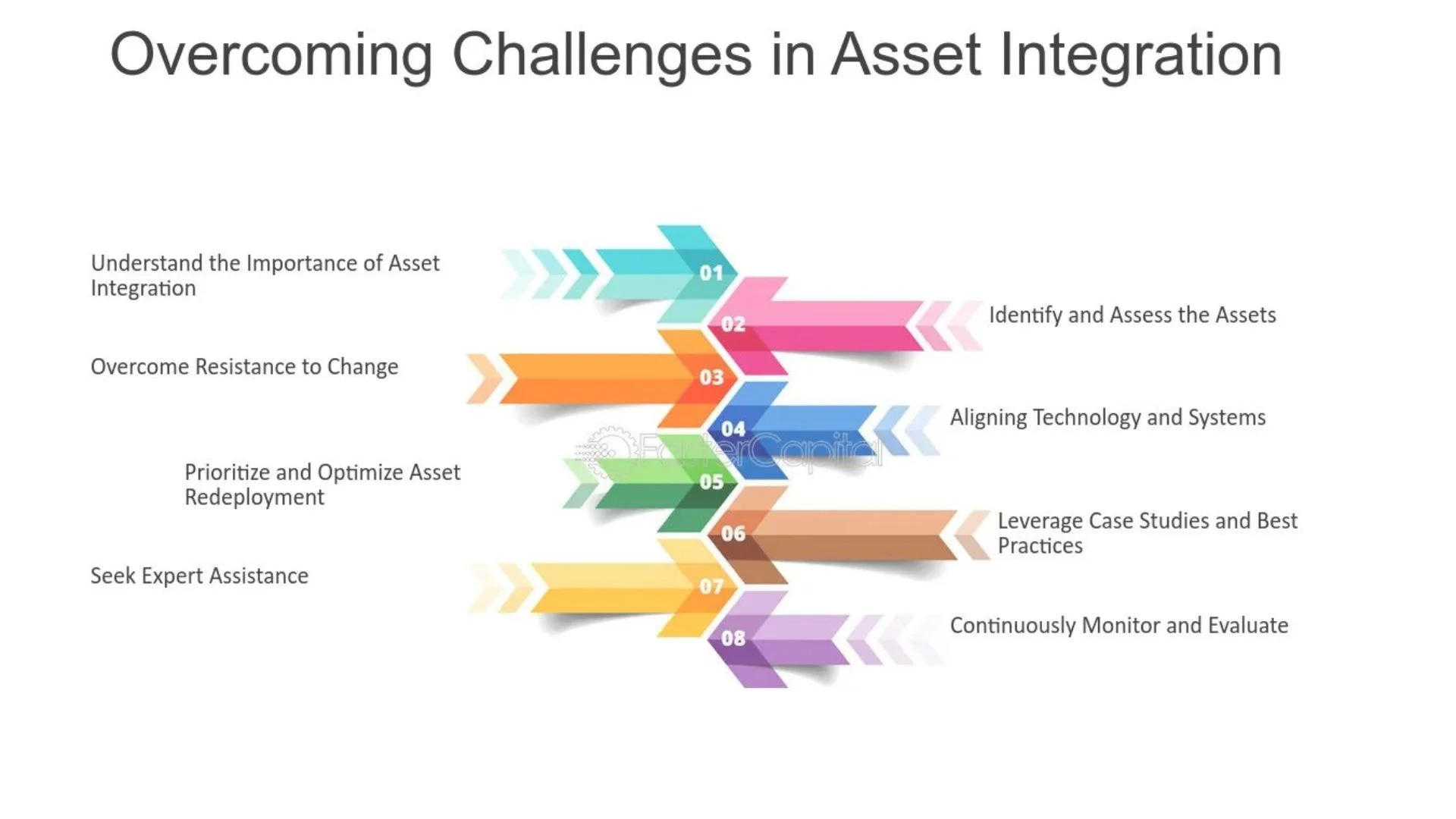

Navigating the Corporate and Asset Finance Landscape

To fully harness the power of this synergistic relationship, businesses must navigate the diverse landscape of corporate and asset finance options, carefully evaluating the available solutions and identifying the most suitable strategies to meet their unique needs and goals.

Evaluating Provider Options

When exploring the world of corporate and asset finance, businesses must carefully evaluate the range of providers in the market, including traditional financial institutions, specialized asset-based lenders, and alternative finance platforms, to determine the most suitable partner for their specific requirements.

Assessing Eligibility Criteria

In addition to evaluating the providers, businesses must also understand the eligibility criteria and underwriting processes associated with corporate and asset finance solutions. This may involve providing detailed financial information, demonstrating a strong credit history, and showcasing the value and viability of their assets.

Maximizing the Impact of Corporate and Asset Finance

To truly unlock the full potential of the synergistic relationship between corporate finance and asset finance, businesses must adopt a strategic and proactive approach, leveraging the available solutions and resources to drive long-term growth and operational excellence.

Aligning with Business Objectives

One of the keys to maximizing the impact of corporate and asset finance is to align these financial solutions with the overall business objectives and strategic priorities. By closely integrating the financing options with their short-term and long-term goals, organizations can ensure a more seamless and impactful implementation.

Leveraging Data and Analytics

Another important aspect of maximizing the impact of corporate and asset finance is the effective use of data and analytics. By harnessing the insights gleaned from their financial and operational data, businesses can make more informed decisions, optimize their financing strategies, and identify new opportunities for growth and efficiency.

The Future of Corporate and Asset Finance

As the global business landscape continues to evolve, the relationship between corporate finance and asset finance is poised to undergo its own dynamic transformation, with advancements in technology, shifting regulatory environments, and the emergence of innovative financing models shaping the path forward.

Technological Innovations

One of the key drivers of change in the corporate and asset finance landscape is the integration of cutting-edge technologies, such as artificial intelligence, blockchain, and advanced data analytics. These innovations have the potential to streamline the financing process, enhance risk management, and unlock new levels of visibility and transparency within the financial ecosystem.

Evolving Regulatory Frameworks

Alongside technological advancements, the future of corporate and asset finance will also be influenced by the ongoing evolution of regulatory frameworks. As policymakers and industry stakeholders work to address emerging challenges and align with evolving economic conditions, businesses may see changes in areas such as capital requirements, sustainability-focused financing initiatives, and the integration of environmental, social, and governance (ESG) principles into financing decisions.

Collaborative and Ecosystem-Driven Approaches

In the years to come, the corporate and asset finance landscape may also witness the emergence of more collaborative and ecosystem-driven approaches. This could involve the creation of specialized finance platforms, the formation of industry-specific partnerships, and the integration of corporate and asset finance solutions into broader enterprise resource planning (ERP) and supply chain management systems.

Personalization and Customization

Ultimately, the future of corporate and asset finance is likely to be defined by an increased focus on personalization and customization, as providers strive to deliver tailored solutions that cater to the unique needs and challenges faced by businesses across various industries and growth stages. This could encompass the development of modular financing packages, the integration of predictive analytics to anticipate and address emerging financial challenges, and the provision of seamless digital experiences that empower businesses to manage their financial and operational requirements with greater ease and efficiency.

Conclusion

In the dynamic and ever-evolving world of business, the synergistic relationship between corporate finance and asset finance has emerged as a powerful driver of growth, enabling organizations to navigate the complex financial landscape with greater agility, resilience, and strategic foresight.

By seamlessly integrating these complementary financial solutions, businesses can unlock a range of strategic and operational advantages, including optimized capital allocation, enhanced financial flexibility, improved risk management, and unlocked growth potential. This holistic approach to financial management equips organizations with the necessary tools and resources to adapt to changing market conditions, seize emerging opportunities, and solidify their competitive position in an increasingly challenging business environment.

As the future unfolds, the corporate and asset finance landscape is poised to undergo a transformative evolution, driven by the integration of cutting-edge technologies, the evolution of regulatory frameworks, and the emergence of collaborative, ecosystem-driven approaches. These advancements promise to further enhance the accessibility, customization, and impact of these financial solutions, empowering businesses to navigate the complexities of the modern business landscape with greater confidence and agility.

Ultimately, the synergistic relationship between corporate finance and asset finance represents a critical component in the ongoing quest to fuel the growth and success of businesses across a wide range of industries. By providing the necessary financial support and strategic guidance, these integrated solutions enable organizations to focus on what they do best – innovating, expanding, and creating value for their stakeholders, driving economic prosperity, and shaping the future of the global business landscape.